In Living Color: Images Explain the "El Niño Neutral" Impact on Global Crops & Commodity Markets

(WEAT) (ZWN25) (KEN25) (CORN) (ZCN25) (SOYB) (ZSN25) (TAGS) (DBA) (KCN25) (CTN25) (SBNC) (CANE) (CCU25) (NGM25) (UNG) (BOIL) (KOLD)

"In Living Color: Images Explain El Nino Neutral’s Impact On Global Cros & Commodity Markets"

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Scott Mathews, Editor

- Weekend Report - May 9-11, 2025

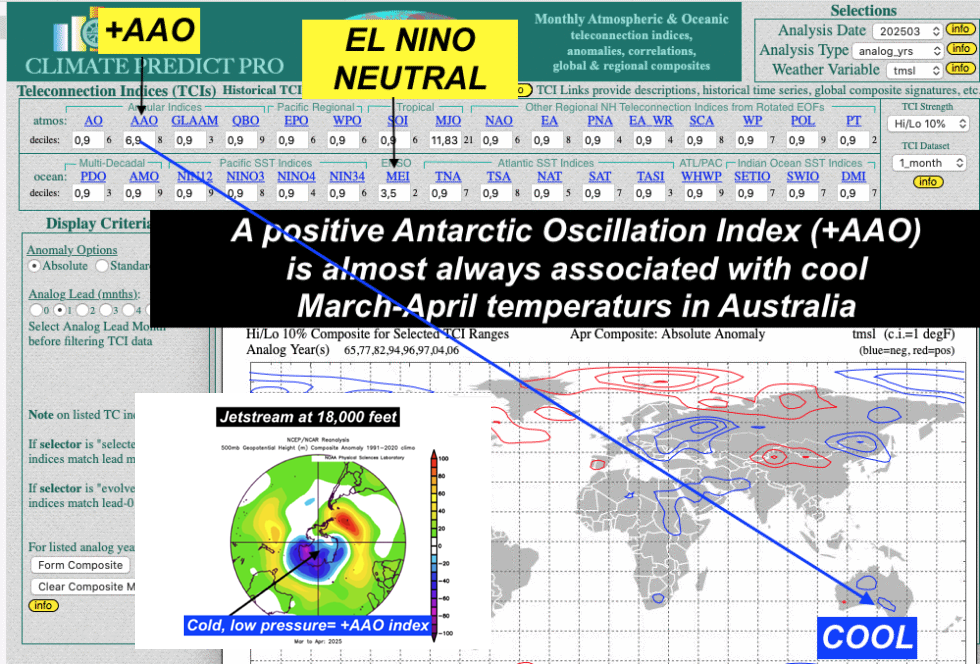

Source: Screenshot by Climate Predict LLC

- superimposed comments and markers by BestWeather

- insert of Pacific Walker Circulation image by NOAA

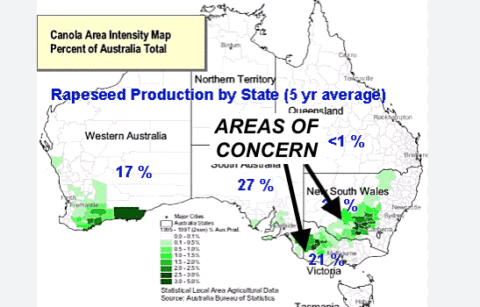

While the grain futures have been mostly in a bear market, even with a weaker dollar, commodities from gold to cocoa and coffee continue in bull trends. Canola prices have really been perking up.

Potentially, there is a global weather problem as the drought in China is beginning to affect some crops in parts of southern Australia.

Below, I discuss how weather and the El Niño neutral stage (neither El Niño or La Niña) is affecting every commodity from wheat to ideal Midwest corn belt weather, previous crop problems in West African cocoa and why global sugar weather is improving. How about natural gas and a possible hot summer?

As a WeatherWealth newsletter subscriber, not only do you receive trading ideas, but you also see much more accurate weather information as we “second guess” standard weather models by looking at these 28 global weather teleconnections for all Ag and natural gas commodities.

—Enjoy Jim Roemer

Source: map by USDA

- commentary and indicator arrows added by BestWeather

Source: price graph by Barchart.com

- indicator arrow and superimposed wording by BestWeather

- Source: screenshot by Climate Predict LLC

- Source: screenshot by Climate Predict LLC with comments and indicator arrows superimposed by BestWeather

- Source: map by Agri-Food Canada (a national information service)

Source: maps by stormvistawxmodels.com - used by permission

- superimposed comment and indicator arrow by BestWeather

Source: map by WeatherBELL - used by permission

Sources: three screenshots above by Climate Predict LLC

- superimposed comments and indicator arrows by BestWeather

- antarctic polar projection map insert by NOAA, with superimposed markers by BestWeather

- Source: maps by WeatherBELL (used by permission) - arrow superimposed by BestWeather

- Source: map by WeatherBELL - used by permission

- Source: maps by NOAA with superimposed labels and comments by BestWeather

- Source: map by NOAA with superimposed arrow indicator by BestWeather

Sources: seasonality table by MRCI (used by permission), with superimposed elements by BestWeather

- Map by stormvistawxmodels.com - used by permission - comments and indicators by BestWeather

- Source: BestWeather Spider - royalty free natural gas flair photo by pexels.com

What about the coffee market, which reached all time high prices earlier this winter?

Is there any chance for a hot-dry summer for Midwest grains?

We invite you to request a complimentary past issue of WeatherWealth here, or better yet, receive a 2-week free trial and see our trade recommendations. (You can cancel at any time)

- Artwork created via AI software DALL-E 3 and is the property of BestWeather

Thanks for your interest in commodity weather!!!

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He also is a co-founder of Climate Predict LLC, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.